Pragma’s research team recently released a new research note titled “The Limits of Price Prediction Algorithms“. The research team took this look at short-term price prediction (on the scale of a few minutes) because of the increase of marketing claims over the last couple of years for price prediction as a significant contributor to execution quality in agency algorithms.

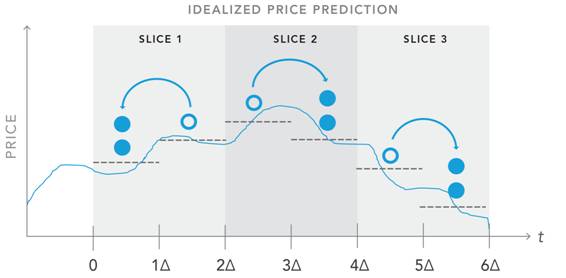

The research note provides a framework for quantifying the value that short-term price prediction can bring to agency-style execution algorithms. The framework starts with a stylized trading problem in which a trader can see a short time into the future, and uses that to develop a bound on the benefit this clairvoyance would provide to expected execution quality. We then extend it to imperfect clairvoyance, and show that under reasonable assumptions of imperfect price prediction on the timescale of a few minutes, price prediction is unlikely to yield large expected performance improvement (where by large we mean something on the order of multiple basis points, as much of the marketing pitches seem to suggest).

The research note also identifies a dangerous illusion of performance that may be introduced when execution is not mandatory: because the opportunity cost of unexecuted shares does not show up in traditional execution quality metrics, even well-intentioned attempts to use price prediction can cause a convincing illusion of good performance when 100% completion of all orders is not required.