The buyside has many interrelated concerns around the US equity market structure: high frequency trading, latency advantages, complex exchange order types, brittleness in the market resulting in “mini flash-crashes,” the sequestration of liquidity in darkpools, and the maker-taker model, among others. But one area that touches each of these but receives little attention is the role of the broker.

The buyside interacts with the market using brokers as their agents. When a buyside trader hands an order to a broker’s desk or algorithm, the broker gains near complete discretion over how that order will be handled. The broker chooses when each share will be executed, where it will be routed or rested, for how long, and (within the constraints of reg NMS) at what price. Reg NMS provides a certain level of protection – indeed, regulators’ view seems to be that as long as brokers trade within the bid-ask spread, clients should be in pretty good shape.

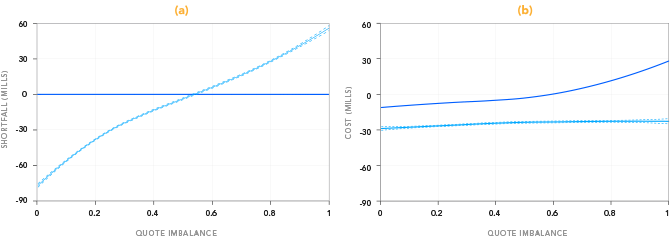

ABOVE: The average (a) shortfall relative to the opposite side and (b) fees and rebates of passive and aggressive strategies for US equities as functions of the quote imbalance. Dashed lines are the standard errors. In both plots, light blue is the passive strategy, and dark blue is the aggressive strategy. Both plots use the convention that positive shortfalls and costs are unfavorable.

However, a great deal of money is at stake within the spread, and brokers stand as conflicted stewards. The spread cost for the market as a whole is something like $125mm/day, or over $30bb/year even at recent anemic volumes (this figure ignores explicit costs like commissions and exchange fees). In principle, any fraction of this might be either siphoned away as trading profit to proprietary traders, or retained within the community of investors and the companies they intend to invest in. Brokers act as agents for the buyside, yet several aspects of the market structure and practice create conflicts of interest, putting brokers’ financial interests in direct conflict with their clients’.

Today Pragma has released its latest research note, Conflict Inherent in the Maker-Taker Model: Equities vs Futures. It looks at the cost and value of crossing the bid-ask spread, and shows that a conflict of interest is created for brokers by the maker-taker system of differential fees and rebates, combined with the flat-fee commissions paid by most institutional clients. By way of contrast, the research note also shows how this conflict is absent from the US futures markets, where there are no such differential fees and rebates.

Over the coming year, we intend to continue to explore related aspects of market structure, hopefully making a unique contribution to the broader market structure debate and providing the buyside with a more detailed understanding of some of the indirect ways that the market structure can affect best execution.